Dear Clients, Colleagues, and Partners,

This marks the third annual company letter I have written to our clients, friends, colleagues, students, and, most importantly, our believers. In my letters from 2020 and 2021, I spoke of the difficulty and uncertainty of those years while maintaining an overall tone of determination and resilience. Today, I come to you from a place of relentless hope and renewed enthusiasm.

This year, SERHANT. experienced immense growth in the face of a fast-correcting market: Our revenue grew by 65%, we crossed $2B in sales, we listed the most expensive home in the US (and the highest on earth) for $250M, and our total people count crossed 310. We broke numerous price records, signed 25 new developments for $2.5B in inventory, and increased our EdTech product membership to over 13,500 enrollees in 110 countries. Our STUDIOS business doubled its output, won a Shorty Award, grew our total following to nearly 6M, and landed project-specific campaigns for brands like Intel, Dell, Royal Caribbean, and Behr. ID LAB doubled in size, and our best-in-class PR team helped our brand generate more than 900 media placements resulting in 16 billion impressions — a 44% increase year-over-year! I started SERHANT. with a mission to create a disruptive, mobile-first real estate ecosystem, self-funded and powered by an in-house production company, creative agency, and sales training platform. Our full company results can be found near the end of this letter, but I must say that while our first two years have been against the odds, we have succeeded far past my wildest projections.

Though 2022 did not unfold as many of us planned, we don’t have to be captive to slowdowns and periods of uncertainty. This past year, global market turbulence led to reduced transaction volumes, plunging valuations in the capital markets, and historic inflationary pressures. At SERHANT., I preach relentlessly that there are no “quiet” times: Markets in transition provide you with more time to build your businesses, soon, on top of our own platform (more on this later). We can help line up your next sale, scale your team, and develop a strategic model for success. We do not accept downtime, and we will not be discouraged by unfavorable market conditions. This year, our staff and agents rallied and supported each other in a way I’ve yet to see in my professional career. Seeing our culture thrive through the volatility of the last nine months motivated me even more as our CEO to invest in our infrastructure, double down on our content-to-commerce strategy, and refine our systems and processes. We cannot control the economy, the financial markets, or the weather, but we can control our fortitude, resolve, and optimism.

----------------------------------------

I want to share a quote by world-renowned lyricist Paulo Coelho de Souza and author of The Alchemist, one of the best-selling books in modern literature: “The more violent the storm the quicker it passes.” This year, I hope you will join me in discovering that the space between two extremes of any period is where we find the resolve to keep moving forward.

Over the last three years, together, we have fought the worst global pandemic in modern history. At the start of 2020, the UK withdrew from the EU. We watched the 2020 Summer Olympics from home as no spectators could attend. A tragic building collapse took nearly 100 lives in Surfside, FL. We struggled through historic heat waves, and many lost everything from Hurricane Ida. We lost Queen Elizabeth II, who ruled with power and grace and touched us all. Prime Minister Shinzo Abe was assassinated. Russia invaded Ukraine. Dramatic increases in inflation and interest rates caused major stress on the global economy and the consumer, with the typical home buyer’s monthly mortgage payments soaring 77% by October (Realtor.com).

But the past three years saw overwhelming successes and triumphs too. The NASA rover Perseverance covered some 292.5 million miles before touching down on Mars in February 2021. In Malawi Africa, the world’s first 3D-printed school opened its 3D-printed doors after being fully built in 15 hours (Wired). United flew a plane on 100% sustainable fuel. The US supply chain is set to receive over $1T in investment and is quickly going digital. The FinTech sector is projected to 3X to $332B by 2028 (Vantage Mkts). Apple became the first company to reach a market cap of $3 trillion. In Europe, electric vehicles (EVs) are outselling diesel-fueled cars. Broadway re-opened after an 18-month pause. Maya Angelou became the first Black woman to be featured on a US quarter and for the first time, women refereed men’s World Cup games.

Million Dollar Listing New York also came to an end this year after an incredible 10-year run and two Emmy nominations. Remember my motto that would play at the beginning of each episode? I’m the guy who said: Expansion - always, in all ways! The truth is that earlier in my career I was terrified of growing too big, too quickly. But I’ve learned that when there’s a new opportunity you’re interested in, take it. If there’s a new client you want to earn business from, ask for that meeting. If you want to learn from your competitors, don’t envy them – make them your partners. Before we get into this year’s letter, here are my three “Coelho-curated” messages for 2023:

“Fear is a bigger obstacle than the obstacle itself.” – I’d rather regret the things I did in building this firm than the things I never tried. Fear in business is the kryptonite of progress.

“Break the monotony” – One of my greatest strengths is my willingness to deviate from the status quo and hold firm. As I speak to the state of the company from 2022, I think you’ll get a sense of how SERHANT. defines breaking traditions.

“Your success has a ripple effect” – Wins beget wins. If you can find ways to succeed in a troubled market, you will find that your partnerships grow stronger, your clients are more loyal, and your positivity will become infectious.

Lastly, as our business grows, so does this annual letter (don’t worry, the web version has hyperlinks for each section!). Digest the sections in pieces if you’d like or take it in all at once. We link to some really interesting reports on topics like Metaverse’s value proposition (Deloitte) as well as cryptocurrencies and the blockchain (Levine, Bloomberg). But, if there’s one piece of content you consume from me this year, let it be this annual letter. Our past predicts the future, and it’s important to absorb what happened across real estate, the economy, prop-tech, Web 3.0, and alternative technologies that are disrupting entire industries. Uncertainty and a lack of consumer confidence hang over us. How we got here, how we leave here, and how we grow stronger are what we will be discussing in the following pages.

Life moves pretty fast, and if we don’t stop and take a look around every once in a while, we could miss those special moments with our families, opportunities for both work and personal growth, and, most importantly, our dedication to supporting others in times of need. As always, my thoughts and opinions in this letter are my own. I thank you in advance for taking the time to read it. My family and everyone here at SERHANT. wish you a healthy, happy, and truly fulfilling year ahead.

US Economic Update

The global economic backdrop has become increasingly concerning for us all. Consumer prices continue to rise, the cost of home ownership is daunting, and the majority of economists are warning us of an imminent recession. After years of accommodative policy for easy access to capital, the “other side” of COVID-19 seems to have surprised many. The federal government spent nearly $4T through September 2022 (usaspending.gov) and that was just in its response to COVID-19.

The markets this year have also been impacted by the two C’s of war: casualties and cost. Russia’s invasion of Ukraine has displaced over 14mm Ukrainians and President Zelensky this month estimated that over 13,000 soldiers and civilians have been killed. The US has indicated it will continue to support Ukraine, having already sent $19.3B to date (state.gov). The fiscal 2023 NDAA (National Defense Authorization Act) will provide $858 billion in military spending, a 4.6% pay increase for the troops, and additional funding for supporting the defense needs of Taiwan and Ukraine (Reuters).

Global volatility has not been isolated to any one financial market. We have witnessed corrections in residential and commercial real estate and seismic sell-offs in equities, bank debt, and global bond indexes. High beta technology stocks have been loss leaders, with alternative technologies like cryptocurrencies tracking closely. Year to date, over 90,000 US technology jobs have been lost (trueup.io), with firms like Meta conducting their first-ever mass lay-offs. The International Monetary Fund has predicted that global GDP will slow to 2.7% in 2023.

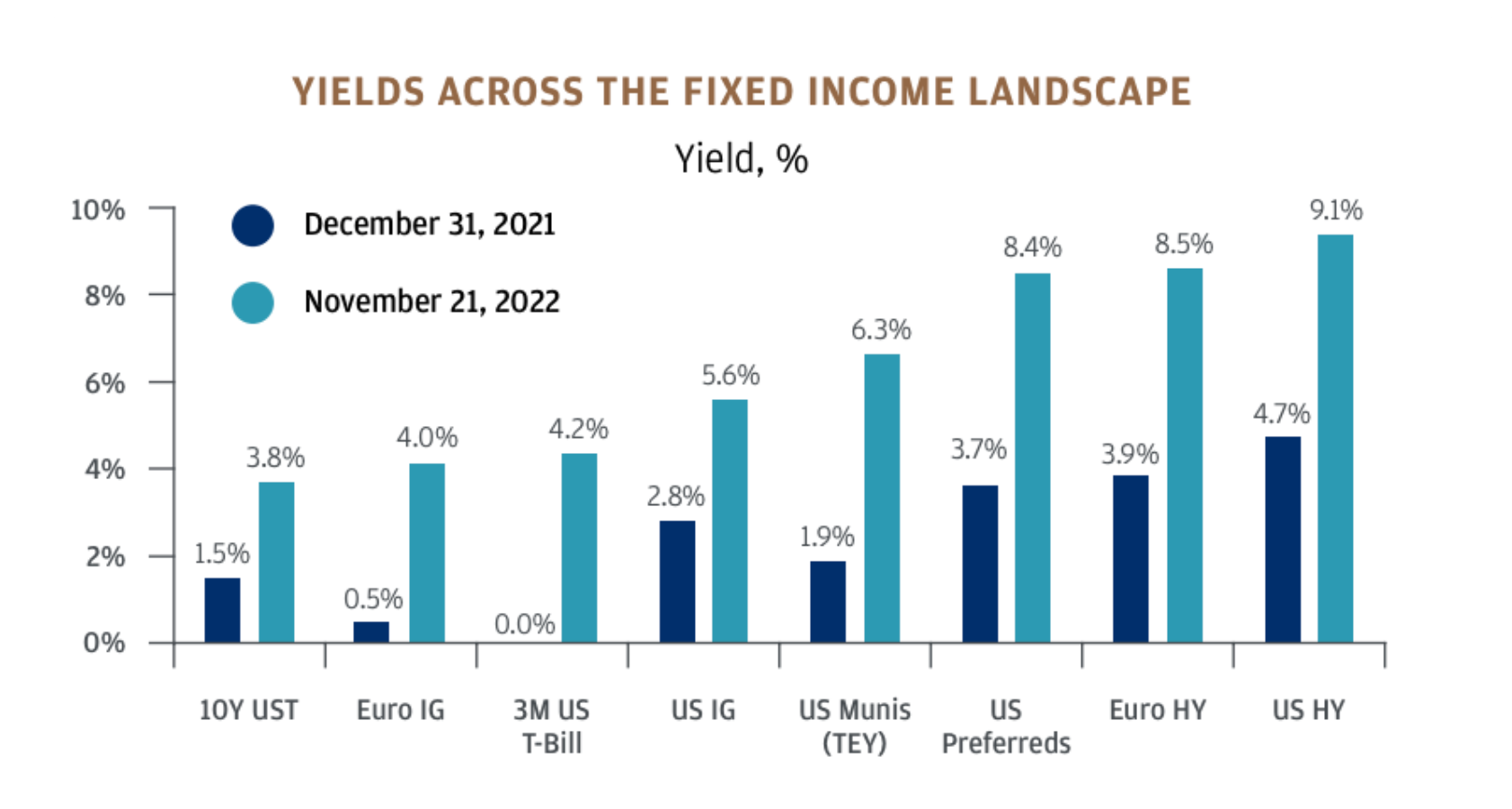

In just one year, 3M treasury bills have surged 4.2x from 0.0% while IG (inv. grade) and HY (high yield) bond yields have nearly doubled (chart: JP Morgan). The S&P 500 is down -16% YTD and the Dow Jones is down -8.5%. MSCI Europe EM bond funds that track mid-cap equities in 15 developed European countries have fallen ~20%. US inflation reached a peak of 9.9% this November compared to a rate of 1.54% (6.5x higher) when the lockdown started in March 2020. To find an inflation rate this high, we’d need to look back to January of 1981 (11.8%). Currently, 26 of the 31 central banks are raising rates, up from just two at the start of 2021. G10 central banks alone hiked rates 350 bps in November (Reuters).

JP Morgan Chase, 2022 Update

Consumer Confidence (CCI) continued to decline this year as inflation expectations, cost of goods and services, and higher borrowing costs restricted consumers’ outlook. The CCI fell to 100.2, a four-month low, in line with consensus estimates. As surging energy and food costs drive inflation expectations higher, buyers have begun to pull back from large ticket items like homes, autos, appliances, and travel. November’s measure of expectations (a six-month outlook for income business and labor) fell to 75.4. Levels below 80 suggest higher recessionary risks (Bloomberg, CCB).

The outlook for wage and job growth is showing signs of strain and less available cash will intensify the burden on housing and automobile markets. Higher interest rates have, as intended, slowed the economy, encouraging investors to curb spending and save money in higher-yielding investments.

Activity in interest rate-sensitive sectors such as real estate has already declined dramatically, as you’ll see in our market reports throughout this year and on Garret Derderian’s The Scoop, which you can watch weekly on the @serhant Instagram page. Instead of moving or refinancing mortgages to build new additions, homeowners are sitting tight. Capital markets are likewise dormant as companies balk at higher financing costs. Globally, the home loan business is down ~75%, the issuance of corporate debt is down ~80%, and initial public offerings are $600B lower than they were in 2021.

Inflation and a weaker economy have affected us all. But as we look forward to 2023, let’s address some areas of optimism and hope. Discounts drove Cyber Monday revenue up 5.8% year-over-year, surpassing estimates and marking the highest daily spend on record. US shoppers spent $11.3B over that four-day span as robust discounts drove demand for inflation-weary consumers. Our Sell it Like Serhant Black Friday sale was the highest revenue-producing event in company history. Adobe Digital reported positive growth across 18 product categories as consumers smooth out spending over longer periods. October US retail sales beat consensus estimates and posted their biggest increase in 8 months (+1.3%) and are up 0.9% ex-gas and auto. 9 of 13 sales categories including gas stations, auto dealers, and restaurants (US Census Board) recorded higher prices year-over-year.

Inflation data was somewhat softer for December as Core CPI was released this past Tuesday (December 13th). The market was somewhat relieved that the Federal Reserve may soon pause their interest rate hikes, but cautious that upcoming data could still be strong enough for them to continue. Core CPI posted its smallest monthly increase since August 2021 and fed funds futures rallied. Stocks rallied alongside fixed-income assets as hopes for an early 2023 pause in this tightening cycle. The core measure (which excludes food and energy) rose by only 0.2%. Yet, food prices remain higher than they've been in decades. In October, the price of groceries rose by more than 12% year-over-year (US Consumer Price Index). The annual headline number is still running above 7%. The Fed issued a 50 bps rate increase at their most recent meeting, 25 bps less than the past three hikes, but indicated the need for continued vigilance. In a best-case scenario, the economy will avoid triggering a recession while working to cool inflation, also known as a “soft landing.” We expect similar volatility in the first half of 2023, followed by stabilizing, and potentially even growing, markets into Q1 2024.

US Real Estate Market

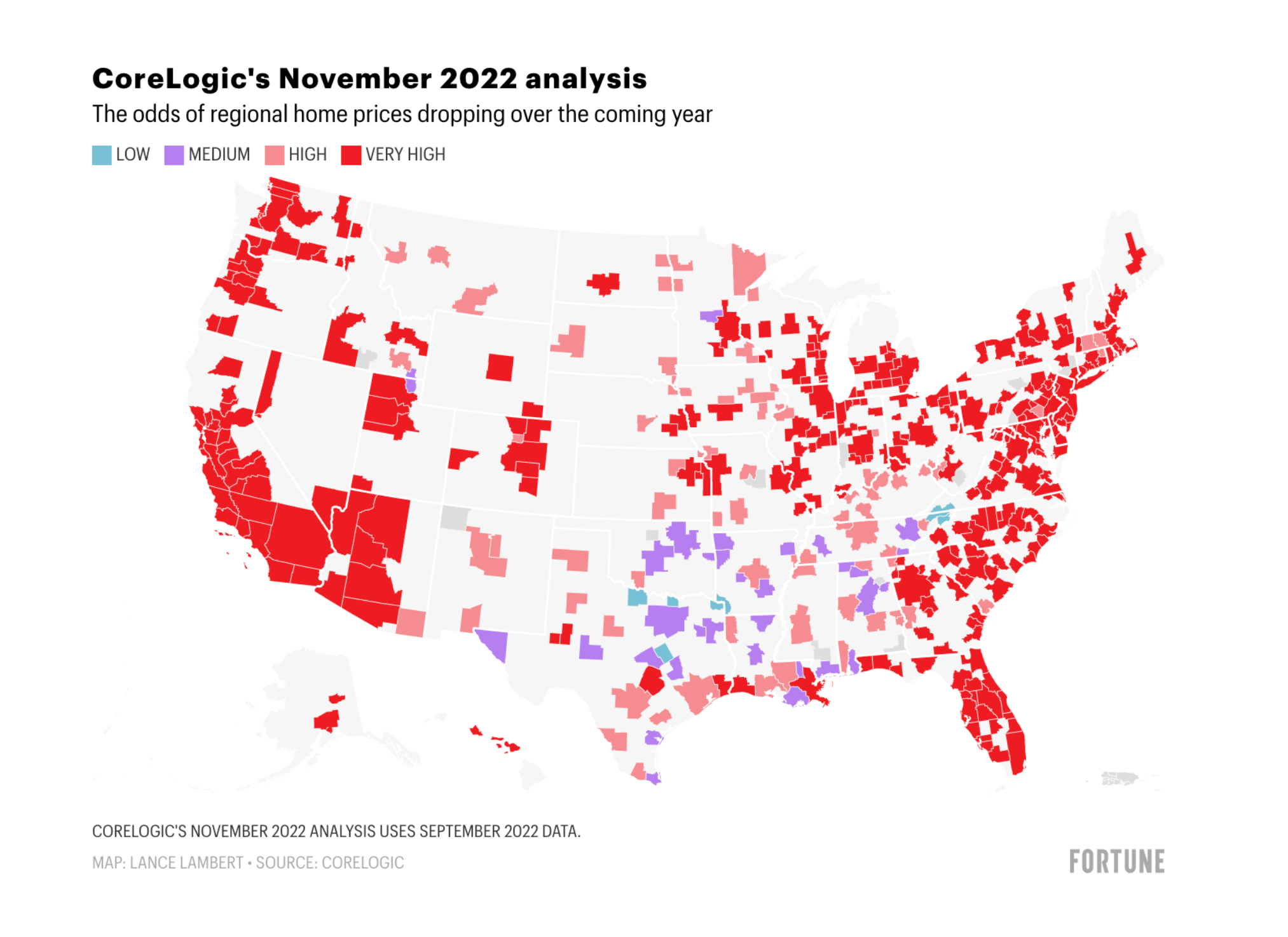

The real estate market has entered a correction zone that is likely to persist and even intensify throughout 2023. This was to be expected. My biggest surprise was that the correction didn’t start sooner than ~April this year. In fact, on October 25th of 2021, I was the lone market defector on a panel at Inman in Vegas. My remarks that the market would start to correct in 2022 were met by my fellow panelists with such disdain and horror that Inman wrote an article about it! The Fed’s tightening has hurt all interest-rate sensitive sectors, which includes both end-user and investment residential and commercial real estate. This year, the mortgage market encountered a rate “shock” when average 30-year fixed mortgage rates advanced from 3% to over 6% for the first time since 1981. With home prices rising 40% during the pandemic housing cycle, the market started to worry about the rally’s longevity. The market braced for an incoming correction. CoreLogic’s analysis of 392 US regional housing markets in November showed that 354 markets had a greater than 50% chance of having a negative year-over-year price decline over the next 12 months vs. 335 in October (CoreLogic, 11/22/22).

The 2023 Bright MLS Housing Market Forecast believes that residential market demand will rebound in 2023 but low inventory will drive sales to a nine-year low. The report suggests mortgage rates will stabilize at 6% and progressively retrace lower throughout 2023. The report also predicts that several markets will see a 10% decline in 2023 but will not even come close to the 30% price reductions seen in 2008 (Bright MLS). Would-be buyers will remain supply-constrained, and with many buyers locking in and timing the market in 2021-22, a segment of 2023’s buyers will be removed. In my opinion, those buyers will not vanish – they will just be delayed to the second half of ‘23. That belief is shaping our strategy and annual planning discussions.

At SERHANT., we are seeing prices decline with pronounced variability across geographies. To make things more difficult, weaker economic conditions and inflation are reducing household wealth and disposable income. With default rates in mortgages, credit cards, and autos, banks become more risk-averse, limiting underwriting activity for weakening or already less favorable credit score profiles. This cycle can slow the pace of recovery and add pressure on already underperforming asset classes and products such as MBS and ABS-backed securities.

By September of this year, US consumers expected a decline in home prices for the 12-month forward period for the first time in two years. By August, the market shifted expectations from a 1.9% average increase in July to a 0.4% decline (Fannie Mae). Rental price change expectations also fell. The decline in home prices has likely been tempered by high-interest rates in higher-income large cities and surrounding areas, causing sellers to rethink moving or selling their homes with new mortgage rates nearly 2x what they currently pay. Home prices in these areas have not declined enough to offset the higher interest burden of moving and refinancing.

In their 2023 “Emerging Trends in Real Estate Report”, the PWC team suggests that there are ten emerging issues driving our market for 2023 and further. Here are a few that stood out to me and that I’d like to share with you as we end 2022.

1: Access to capital for investors, owners, and developers will be more important than ever as we head into the next few years. With valuations down and some losses crystallized, liquidity and funding will drive our markets over this next cycle. Access to the capital markets and private equity is critical in funding a recovery. But if the health of our lenders and investors is sub-optimal, volatility will likely persist. PWC’s survey results showed that the availability of capital from all 13 sources (2023 vs. 2022) will decline year-over-year. The reductions are most pronounced across non-bank financials, debt funds, and GSEs (government-sponsored entities) on the lending side. Private equity, hedge funds, and foreign investors will lead the decline in equity financing into 2023 (PWC, 2022).

2: Market returns and prices may not follow a linear path as demand shifts and buyers return. For example, US commercial property investors experienced phenomenal returns during COVID-19 despite many analysts calling for an industry-wide catastrophe.

3: Total returns during COVID-19 for institutional real estate in the NCREIF Property Index (NP) advanced to ~20% during the four quarters ending mid-2022. The increase was 3X the index's 20-year average. Now, 43 economists and analysts surveyed this October in the ULI’s Center for RE Excellence and Capital Markets expect total returns to drop to 3.8% in 2023 before recovering to 7% in 2024 (PWC, 2022). This is actually a nice, steady, “normal” pace. We may enter a period in which we have to be more content with stable growth and lower volatility as the market adjusts to higher rates.

The Luxury Real Estate Market

SERHANT. experienced another record year in the $10M+ markets. You’ll see more in our company notes later in the letter, but we started the year off with a $50M trade in Palm Beach, halved the year with a $57M trade (the highest PPSF ever for a Manhattan townhouse), listed a $100M property in Miami and a $250M Penthouse in Manhattan (that just premiered on Architectural Digest yesterday) and ended the year with a $50M trade on Billionaire’s Row (all cash transactions). Pulling back and looking at the national markets, the summer months were some of the most difficult on record for luxury. Redfin reports that from June to August, sales declined 28.1% year-over-year, marking the largest fall on National record. The biggest previous decline was -23% in 2012. California saw the worst of the decline as the luxury segment of Oakland fell 64% year-over-year, the worst of all the 50 most populous metros. San Francisco and San Jose each fell over 55%. New York outperformed, falling 11.8%. Interestingly, despite a sharp fall off in sales, median prices actually rose 10.5% year-over-year as of September to $1.1 million (RDNY). Not surprisingly, led by warmer weather, lower taxes, and many large businesses moving their headquarters, the top five luxury metros for price growth (+39.3%) were all in Florida. SERHANT. has capitalized on that trend, including listing the largest oceanfront property in Miami at 355 Ocean for $100M.

Last week, Pacaso–a luxury co-ownership platform–released a report identifying the top ten US luxury markets for 2022. The market continues to grow, especially within destination communities, albeit the pace of sales has been subdued. Pacaso suggests that because high-net-worth buyers are not as reliant on financing, raising rates may be far less of a deal-breaker, especially as prices remain softer. Pacaso points out that the top communities that benefited from year-over-year growth are already well-known, leading second-home luxury destinations.

Source: Pacaso analysis of Optimal Blue mortgage rate lock data through December 6, 2022.

This list is not surprising, which seems to be a theme this year. While 2022 did not go as planned, none of us at SERHANT. were taken off-guard by how the last twelve months have unfolded in the markets. I believe that we will see further growth in off-the-beaten-path luxury markets through 2023 as we also experience a generational shift in what the American Dream means for home ownership. We have followed the data very closely this year at SERHANT., and all of our market reports are available HERE.

Alternative Technologies

At SERHANT., we are working hard to incorporate cutting-edge technology into our various business lines. I believe that the future of real estate will lean heavily on emergent and integrative alternative technologies.

Back in 2020, as we prepared to launch the firm, our team started to research and explore the impact Metaverse, AI/AR, and PropTech will have on the way we work, live, and think about technology. Earlier this year, we launched SERHANT. Univers, an immersive 3D virtual world that allows our agents and staff to interact, have meetings and have FUN in a way you just cannot do over Zoom. As I think about our 2023 expenditures, strategy, and talent acquisition, I am confident that our multi-line luxury brand will become even more progressive. Technology will increase our brand continuity and help integrate our products and services with our clients’ lifestyles. For 2023 and onwards, the most important agenda item will be the development and integration of high-quality technological infrastructure.

While I didn’t initially see them as spaces for CEOs, capital markets, or places to transact, the Metaverse and AI are real and they’re being developed all around us incredibly quickly. We can push these technologies aside and move on or we can learn about them and really think about whether they make sense for our businesses. Could a buyer view an international property from the comfort of their own home, in a fully-realized virtual space, and feel comfortable enough to execute a contract? Can AI not replace, but rather help, our agents with quicker and more informed customer interactions? A well-known developer once told me, “When we miss our biggest trades, we often dismissed our greatest opportunities.” It is my hope for SERHANT.’s clients, team, and partners that we all become more educated and embrace these emergent technologies. Remember, it wasn’t that long ago that we were asking Jeeves, “What is electronic mail?”

Property Technology (PropTech)

The PropTech innovation segment spans residential, commercial, construction, AI, data set processing, marketing strategies, brokerages, landlord/tenant relations, and revenue model verticals. Developers and builders are using PropTech for land search, acquisition, and urban planning, along with creative uses that aid interactions with regulators and approval bodies. Machine Learning and AI allow brokerages and agents to access and interact with big data to predict and model client demands and expectations. Our SERHANT. ADX team is building something we call The Future Index, which will allow our customers to predict pricing to make better investments. Even the critical yet mundane documentation process becomes more efficient as excess time and costs are reduced by increased speed, accuracy, and security.

PropTech investments have been growing in recent years, with more than $28.6 billion in equity investments and 2,635 deals between 2015 and 2020. Despite challenges in the global economy, PropTech investment and M&A activity have not slowed down, with Houlihan Lokey reporting over $8 billion in growth equity and debt funding and several $1+ billion M&A transactions in the US PropTech market in the first half of 2022 (HL, PropTech Market Update July 2022). In terms of valuations, RE Media Portals had the highest market valuations at 18.7 times EV/EBITDA in 2022, while Commercial Brokerages were valued at the lowest multiple at 6.3 times EV/EBITDA. Residential Brokerages traded at 10.4 times EV/EBITDA. As the PropTech market continues to mature and potentially receive more funding from both public and private sources, it is likely that valuations and the overall size of the PropTech ecosystem will increase. And as firms capitalize on the ever-growing rental community, we’ll see more deals like the recently completed $1.5B BILT Rewards funding round.

Integrating Proptech into the SERHANT. Ecosystem

Today, SERHANT. is enjoying explosive growth in our PropTech initiatives across our triumvirate of businesses: cloud brokerage, sales training, and content studio. We are steadfast in leveraging technology to provide our customers with bespoke products and services that increase utility and efficiency. This year, I have made a commitment to fund our R&D efforts in a rapidly evolving market. Below, I’ll highlight where technology is being used to grow several of our business units and the products and services that they offer. Developments in PropTech are changing the way we search, explore, and transact. Some of our projects are still in the early developmental stages. Please keep an eye on our social media and various communication channels as we will be sharing updates on them throughout 2023:

The SERHANT. ADX team worked closely with our R&D team to improve our Search & Distribute Listing Targeting Systems using GPT-3's Babbage, Curie, and Davinci. We also launched S.RM, a next-generation CRM and marketing toolkit with a PropTech focus. S.RM's web and mobile app are feature-mirrored 1:1 and include a TikTok-style video production and editing tool with AI-generated listing info stickers, elegant tour sheets, offline open house registration pages, intelligent drip flows and automation, one-click single property websites, and more. S.RM is a foundational platform for the future.

On the heels of incorporating an AI-managed media cataloguer and indexer with speech and facial recognition to enhance our content workflow efficiency in 2022, SERHANT. Studios will be operating in more locations due to further expansion in 2023. We have formed a partnership with Alteon to enable our Studios team members to work from anywhere while capturing the most stunning property footage and beyond–with no bottlenecks or production delays. Alteon is the fastest-growing and most exciting AI-enhanced cloud video editing platform and recently announced formal partnerships with Apple, Black Magic Design, IBM, and several leading media outlets. Without giving too much away, let’s just say that 2023 will have a more quantum feel as we double down on our content-to-commerce strategy for real estate sales. This year, STUDIOS also released its first app, SPACES, which allows our agents to create property tours on the go. Fully editable in real-time, with music, filters, and text options, agents can now make quick and highly-produced video tours for clients and share them on all platforms instantaneously. You can watch SPACES tours on our @serhant social pages!

Our High-Net-Worth division, SERHANT. Signature, focuses on the $10M+ marketplace for buyers and sellers. SERHANT. listings that are $10M+ receive our SERHANT. Signature treatment and marketing package, setting a towering new global standard for exposure excellence. Beginning in 2022 and continuing into 2023, the bar is being raised even higher via the inclusion of tools that allow prospective buyers to interact with hyper-real 3D models of homes while quickly and easily swapping exterior and interior styles, palettes, building materials, and finishes to help visualize how they can make a space their own.

In 2022, our in-house creative agency team ID LAB dove into the PropTech ocean by leveraging ML-enhanced demographic models to inform and guide specific micro-design and copy decisions that optimize branding and adverts for the target markets our partnered developers want to reach.

Our New Development division, led by Craine’s 2022 Notable Leader in Real Estate Jennifer Alese, implemented a cutting-edge lead assignment and tracking system. Fully integrated across our stack and atop our powerful S.RM (Serhant Relationship Manager), this new system complements an already powerful and market-leading division. In 2023, we will be building a visualization tech package, ensuring agents and prospects get connected quickly and stay connected deeply from first contact through contract signing and closing.

While some projects are still Top S.ecret and have a tight lid on them for the time being, our R&D team made tremendous leaps in the practical blockchain applications for the PropTech space. Our SERHANT. Sealed platform is a first-of-its-kind NFO (Non-Fungible Offers) tool that offers buyers’ agents and their clients a brand new way to make integrity-based opening offers on listings to maximize the conversations taking place. The R&D team also devised a next-gen agent and client interaction platform to meet the loud demands of the market, which we are excited to share more about in the coming months.

Integrating AI/Machine Learning with the Real Estate Industry

There are new technological frontiers that we are just beginning to explore. As these opportunities and applications proliferate, we may see connections among asset classes that we never even considered. The big three I’d like to touch on are the Metaverse, AI/AR, and PropTech. We will monetize gaming, entertainment, and digital competitions and use VR to attend paid-for live events like the Super Bowl, The Grammy’s, and movie premieres. We will do more VR-supported global luxury showings and closings and be more readily available for our developers. We will see capital markets almost entirely supported by fintech while PropTech supports real estate. It will be our job to strike an efficient balance between human interaction and technology. I see it as “leveraging” and not “replacing” our face-to-face business, which success requires.

With US housing now a $16T market, AI, AR, and machine learning have the power to increase efficiency and production for our industry. Many other of the largest asset classes in real estate, media, banking, transportation, sports, and education will develop their own systems and partnerships with developers. The global AI and AR sectors in the real estate market were valued at $298.6 million and are expected to reach $1.2 billion in 2023 (WeAR Studio). In real estate specifically, bots or machines are helping to decide everything from prices to interior decorating, materials procurement, how we list, and who we list with. I wrote a LinkedIn article about this exact topic a few months ago. Appraisers and banks can access mortgage AVMs (Automated Valuation Models) to use modeling and data analytics software to determine valuations. Lenders use them to make fast and affordable estimations of property values and buyers/owners use them to see value estimates.

AI and machine learning might have the power to improve operations in building management and the selection and procurement of materials for interior design. It could even help us match clients to properties through complex remote surveys. AI can help agents better communicate with clients 24/7, anywhere in the world. It will help brokerages with talent acquisition and employee management. AR (augmented reality) technology offers advanced visualization for things like 3D remote property tours, helping agents save time and run larger client books. At SERHANT., where we are heavily invested in our media brand, we can focus on expansion by taking more calculated risks. A more data-driven real estate market will create synergies between complementary businesses, allowing teams to work more collaboratively. AI/AR can help increase our bottom line and allow us to do more business development projects. Companies may be able to expand into new physical and virtual territories, which will increase competition and can lead to new opportunities.

WARNING: With AI/AR’s potential benefits and perceived staying power, significant risks should not be ignored. Jobs may be lost to the technology sector or made redundant through increasing efficiency or substituting with the very machines we’ve created. Employee morale can be reduced, and the utility provided by AI could be offset by a net reduction in productivity. Jobs may become “tech-centric” and companies like SERHANT. will be required to fund expensive in-house development programs to keep pace with our growth. Systems might be exploited, hacked, go offline, or produce erroneous data output. Through an attack, services could be frozen or greatly reduced leading to lower transaction volumes and revenue. The “human” side of our relationships could deteriorate. AI could reduce creativity as humans need to decide how to create, promote and utilize data. AI operates and is “learning” 24 hours a day. Do we want to work in the same capacity? Do we really want to compete with the technology we are creating? Technology offers us an opportunity to adopt, adapt, and create. We need to co-exist with these new frontiers while maintaining our empathy and not becoming subservient to machines and bots.

The Cryptocurrencies, Digital Assets, and Decentralized Finance

The alternative technology space is ending 2022 with instability in investor liquidity, growing regulatory pressures, and a pronounced aversion from institutional accounts. The total market cap of crypto has fallen by over $2T from an 11/8/21 high of ~$3T to $891B on 12/9/22. BTC prices have fallen ~75% from their 11/10/21 high of $69,044 to under $17,000 as of this writing. BTC “dominance” measures the size of BTC’s market cap relative to the total market and that in times of health and expansion, relative BTC ratios are higher vs. altcoins. Year-over-year BTC dominance fell over 50% from 69% dominance to 37% today (Coin Gecko). If you are interested, I’d suggest taking a look at Matt Levine’s (Bloomberg) “The Crypto Story” (10/2022), which is a phenomenal and comprehensive guide that covers both the history, use-cases, risk, and outlook for the cryptocurrency market.

The DeFi (decentralized finance) sector, a good barometer of “transactional” health, also saw notable declines, with its market cap falling from its $173.7B peak on 11/11/21 to just $39B today (12/9/22). DeFi uses emerging technology to remove third parties and centralized institutions from financial transactions. Regarding the NFT (non-fungible token markets) sector, sales have fallen dramatically with skepticism around usability, the depth of market liquidity, and the market’s inability to monitor actual turnover statistics. As such, NFT market sales, which peaked at 90,120 ($91.3mm) on 11/17/22, have now declined nearly 9x to just 7,179 ($10mm) on 12/9/22 (Coin Gecko). Decentralized exchanges have started to outperform centralized ones (CEXs i.e Coinbase, Gemini, Binance), especially as the risk of contagion remains high. If regulation is effective, the crypto market may actually benefit as market-trusted institutional players like Fidelity and State Street should have the ability to replace higher-risk CEXs.

Two catastrophic failures roiled the market this past year. First, in May, Terraform Labs UST coin–a non-asset backed algorithmic stablecoin on the Terra network–failed, triggering a ~$60B washout in global cryptocurrency. And then in November, just when the market was showing signs of recovery, Sam Bankman-Fried’s FTX exchange and hedge fund arm Alameida imploded. Nearly overnight, Bankman surrendered a $26.5B estimated fortune to the market. Leading up to the crash, FTX traded at a $32B valuation and earned the backing of the world's largest money managers, celebrities, sports teams, and their stadiums. Major League Baseball even used FTX logos on umpires’ World Series uniforms. Prior to the crash, FTX-owned hedge fund Alameida had AUM of nearly $15B (June 30, 2022). The insolvency of FTX rippled through the broader markets, eliminating the equity and valuations of several other CEXs (centralized exchanges) and institutional-sized market makers. Many crypto hedge funds began to show signs of instability and the market remains uneasy today. Additionally, many large institutional investors who recently started buying cryptocurrency suddenly found liquidity conditions deteriorating and withdrawals being halted.

Both of these cases are now pending bankruptcy court and criminal charges have been filed. An already doubtful global regulatory community is now scrambling to protect investors and punish bad actors in an industry where anonymity is paramount. In my opinion, these two failures have caused a setback in cryptocurrencies and emergent technology that may deepen without a restructuring that brings crypto under an umbrella with the broader capital markets. I believe that cryptocurrencies are in a transitory period. I am actually hopeful that more regulation around exchanges will provide institutional investors a safer onramp to the sector. We already have some of the finest asset managers and traditional exchanges expanding their infrastructure. In fact, the day that FTX’s bankruptcy was announced, several US asset managers like Fidelity, opened their crypto portals for client registration.

Exploring the Metaverse

The market is becoming younger and more tech-savvy, and these trends extend far into our global landscape. First, I’d urge you to take a spin through a phenomenal McKinsey report on the Metaverse, “Value Creation in the Metaverse - The Real Business of the Virtual World” (June 2022). Some skeptics see the Metaverse as an extension of older iterations of gaming. The McKinsey team, however, sees it as the next iteration of the internet in which the global network of platforms and devices will merge with our digital and physical lives (I side with the latter). There has been massive-scale funding of projects from private equity, venture capital, and corporations. $120B has been invested in the first five months of 2022, nearly 2x the $57B outlay in 2021 (McKinsey). Drivers of this rapid expansion come from B2B and B2C enterprises, social networks, consumer behavioral shifts, leisure activities, education, and devices (VR, AR, etc). McKinsey reported through a 3,400-person study that 95% of polled business leaders expected the Metaverse to have a positive impact on their industry within 5-10 years. By 2030, it’s estimated that the Metaverse could have a $5T global impact. This is equal to the GDP of the world’s third-largest economy, Japan.

The categories of consumer goods that are expected to increase the most are all important ingredients for the growth of the Metaverse. Annual spending is projected to rise across both the digital assets we use today and the digital assets that benefit the Metaverse. One interesting point is that these categories have significant crossover and transferability. Regular consumption of video games, movies, books, and audio content may be reduced over time, increasing wallet share within the Metaverse. As consumers integrate with this technology, growth in NFTs, virtual real estate, and gaming may accelerate even faster with more capital investment and R&D programs and adoption by younger generations. Remember, Gen X built the internet but Millennials made it useful. Millennials are building Web 3.0, but it will be Gen Alpha who will make it relevant.

The Metaverse isn’t just for VR and video game companies. SERHANT. uses it with Univers, allowing our entire ecosystem to interact virtually, 24/7. In fact, ProShares now offers a thematic ProShares Metaverse ETF (VERS) that invests in ~40 companies that support the virtual and augmented worlds of the Metaverse. Please click the above link to read about how ProShares is thinking about the Metaverse space.

(McKinsey & Co.)

The Value of Land in the Metaverse and Crypto-Assets

Many aspects of the Metaverse are tied to the real estate market. In their online magazine, Cointelegraph wrote: “People imagine this as a second life. . . in the virtual world people can have a better virtual house than others. . . from space pods to jungle islands and celebrity neighbors, users want to feel like they are someplace special.” The concept of buying virtual land is becoming more common as gaming ecosystems become real estate centric. Has the market for virtual real estate died down substantially in 2022? Of course. Has the invention of the same and the investment potential been emblazoned into our psyche? Yes! If you come to SERHANT. House New York, you’ll hear and see “Mission 2030” a lot. Don’t be fooled by this year’s virtual winter - this decade of change has only just begun.

In the Metaverse, property can be bought, developed, sold, or transferred just like in our own market. The medium of exchange is either goods and services or the native currency–which is almost always convertible to fiat currency. This is what makes the Metaverse more “real” – it can create and store value.

For example, Decentraland (MANA) is a cryptocurrency that allows users to purchase, develop and trade virtual land with no central authority. But with the sell-off in cryptocurrencies, Metaverse-linked tokens have underperformed dramatically, as has daily usage. Many investors believe the Metaverse has staying power and expect the market will surpass historical peaks in market cap after a correction. The “big three” Metaverse cryptocurrencies, AXS (Axie Infinity), MANA (Decentraland), and SAND (Sandbox), heavily leverage real estate networks. The performance of these virtual worlds has been poor at best. In the fall of 2021, these cryptocurrencies had a peak market cap of ~$25.6B (Coinmarketcap). Today, their market cap is just $2.3B, an 11X reduction. For comparison, the DeFi market declined only 4.6X over the like period. If you can stomach the volatility, I have included a link to one of the market’s most comprehensive guides: "How to Buy Land in the Metaverse: A Complete Guide" produced by “The Metaverse Insider”.

The SERHANT. Ecosystem

“The most valuable businesses of coming decades will be built by entrepreneurs who seek to empower people rather than try to make them obsolete.”

-Peter Thiel, Zero to One

Our SERHANT. flywheel took off in 2022 and is moving quickly into 2023. The revolutionary SERHANT. House concept has been an overwhelming success, allowing us to further advance our position that culture, not cubicles, drives a person’s willingness to work in the new world. The spaces–of which we just opened our second this past summer with SERHANT. House Hamptons–inspire networking and collaboration and develop a united culture and unique workplace energy. We continue to sell properties of all sizes and prices through all content verticals, and we remain the #1 most followed real estate brokerage brand in the world. Our education platform continues to grow faster than we can hire to support it. We have gained market share so quickly as a firm that an article written earlier this year in New York Magazine specifically addressed our ability to attract and acquire market-leading talent.

I’d like to take some time to discuss SERHANT.’s growth and triumphs this year across all of our businesses and departments. Our teams have worked incredibly hard against intense macro negativity. As you’ll see in the following updates, we are committed to radical flexibility in our mission to be best-in-class.

2022 was a year of incredible growth for SERHANT., and nowhere was that more apparent than among our in-house talent. Our operations, education, creative, and support staff increased by 70%, the result of hiring 65 new full-time employees across twelve states. On the sales side, we started the year with 108 agents and will end the year having nearly doubled our headcount to 250. We were very active in new talent acquisition, hiring Paul Bologna as our Executive Manager of Sales in New York City and Adrianna Nava to anchor our newly opened Hamptons House. We established a robust presence on Long Island by adding the Michael Sadis Team and the Rachel King Team. As the market began to correct, we attracted even more talent from our competitors. We onboarded powerhouse teams led by Tamir Shemesh, David Fernandez, Abigail Palanca, Maggie Wu, Brandon and Mallory Bogard, Greg Vladi, and many other strategic hires.

This year, our commitment to HR, recruitment, and operations supported increases in market penetration and boosted our financial performance. Additionally, we hired Renee Fitzgerald as our Director of Operations and implemented staff and agent onboarding programs to increase cross-functional awareness. We worked collaboratively across businesses to deliver cutting-edge and unique resources like market seminars and retirement literacy programs. We hosted our first annual company-wide offsite planning event, two town halls, company-wide team huddles, and many virtual "amp hours" for professional development. We increased our benefits offerings and created a fellowship program. The SERHANT. team continued to develop a ground-up culture in which celebrations for Black History Month, Pride Month, Hispanic Heritage Month, and Spring at SERHANT. increased connectivity across groups and a spirit of acceptance.

For us, it's not about having the largest agent and staff count — it's about building the country's most respected, most productive, and most talented people base. We want to help our agents grow their own brands and to give our staff the platform to further hone their skills and become leaders in their respective roles. We remain a destination for talent in all areas of business, real estate, media, and education. People make our business go, and we will always look to bring on the best.

SERHANT. Signature, our Private Client division for buyers and sellers in the $10M+ market and higher, has far exceeded our expectations. In July, we listed the Penthouse at Central Park Tower for $250M, breaking our own record for the most expensive active listing in New York City’s history and the most expensive in the United States. Perched 1,416 feet above Manhattan, the Penthouse is the highest home on earth. In Miami, we listed 355 Ocean Boulevard in Golden Beach for $100M. In total, our Signature department completed over twenty-five $10M+ sales between New York and Florida, including 1330 North Lake in Palm Beach for just under $50M, 36 East 68th Street for $57M (which we sold over FaceTime), 123 East 61st for $17.3M, 217 West 57th, #124 for $50M, and more. All of Signature’s $10M+ transactions are handled with concierge-level service, establishing the division among the best in the high-end luxury market in a very short period of time.

SERHANT. ID LAB, our strategic sales ideation and creative workshop, churned out a mountain of bold, eye-catching content throughout 2022. Led by our Director of Creative and Marketing, Kristen Kipilla, ID LAB doubled its staff count and produced a range of agent-specific templates, tools, and creative resources. These materials help our agent teams develop their businesses and brand identities. ID Lab implemented a new Signature listing package and content suite in collaboration with STUDIOS. They also worked hard to craft an exciting new 2023 brand campaign across a diverse set of clients and partners.

Our best-in-class, in-house film production company SERHANT. STUDIOS had a banner year. The team doubled in size, total views increased 85% year-over-year, and they created eighty custom videos for new development partners as well as 300 property tours for SERHANT. agents. Our Tours for Agents program increased 133% year-over-year. STUDIOS brought on a number of elite brand strategists and photographers for agent brand development initiatives. We further increased our foreign language property tour offerings to include Spanish, Italian, Mandarin, and Hindi. LISTED, a first-of-its-kind media network in partnership with YouTube, is now offered weekly and has produced eight pilots and fifty-three total episodes representing a 212% increase in production year-over-year. STUDIO’s new fellowship program invites young up-and-coming content producers to collaborate with the team. STUDIOS also created, programmed, and launched our agent podcast studio, which has been wildly successful.

STUDIOS continues to evolve as a revenue generator and has crafted project-specific campaigns for brands like Intel, Dell, Royal Caribbean, and Behr. The team was behind the content for Black History Month, Pride Month, Spring at SERHANT., and Hispanic Heritage Month. STUDIOS business grew our total following to nearly 6M viewers and won a Shorty Award along the way!

SERHANT. New Development grew at a strong pace in 2022 and won many significant new projects throughout NYC. The staff doubled in size (a theme this year at SERHANT.!) and we signed and launched 25 new properties totaling $2.5B in inventory. Our Director of New Development, Jennifer Alese, was named a Notable Leader in Crain’s for her outstanding efforts in New York’s New Development arena. We expanded our research offerings for developers and sold $100M in volume at both Brooklyn Point and Quay Tower.

Prominent launches included 100 Vandam, The Westly, The Huron, and Iris Tribeca. We also took on penthouse projects at 277 5th Avenue, 67 Franklin, and 98 Front in Dumbo in collaboration with SERHANT. Signature. We launched 12 new projects in collaboration with our powerhouse agents from The Shemesh Team, Bogard Team, and Team Fernandez, including Everly in SoHo, Manor 82, and 561 Pacific.

Led by Director of Market Intelligence Garrett Derderian, our RESEARCH desk provides clients with a full suite of products developed in-house with support from top economists, consultants, teachers, and databases. In 2022, we expanded our coverage to include the Hamptons in addition to New York City and South Florida. Media press generation is up 17.8% year-over-year not including syndication, with Mansion Global, Financial Times, NY Post, The Real Deal, Bloomberg, and Brick Underground being our top outlets. The Scoop was expanded to include a weekly agent guest to give on-the-ground insights into the local markets we operate in. Our quarterly reports have quickly become the gold standard within the industry and cover the Manhattan, Manhattan New Development, Brooklyn, Brooklyn New Development, Long Island City, Townhouse, South Florida, and Signature markets.

Our EdTech business, Sell it Like Serhant, hit several key milestones in 2022 as we recorded our highest revenue year, our highest revenue month, and our highest revenue day in the history of the business. Operating at an 85% gross profit margin, our mission in this business is to teach the world to sell. We understand more than anyone that sales is the skillset of the new economy, and we are here to support that workforce. Our staff MORE than doubled, and we crossed the 13,500-enrollee threshold. We now have members in 110 countries!

Additionally, we created two new courses, held seven events, and launched Performance Coaching, Serhant Preferred, and B2B offerings. We also signed a pre-licensing partnership with CE Shop. Our newly minted newsletter, The Sales Lede, is achieving a 40% open rate, and we now offer our first-ever synchronous course: Business in a Box - Growth and Scaling for Real Estate Agents. We will continue to expand our curriculum and design course and membership offerings that can help service salespersons across all industries.

The SERHANT. Research & Development team led by Chief Technology Officer, Ryan Coyne, continued the department’s momentum with an even stronger 2022 by enhancing our existing stack and bringing exciting new products to life. Continuing our commitment to facilitating work from anywhere, on any device, at any time, we launched SERHANT. Univers, our private Metaverse entered open (internal) Beta and began connecting our staff, agents, and their clients in ways that deepen how they interact and communicate.

More exciting than that, our integrated central operating system of the future allows agents to mix and match the tools that help them to maintain data interconnectedness. It is already syncing hundreds of thousands of database objects per day, giving our agents more flexibility among systems than at any other firm – ever. We call this platform, Come as You Sell (CAYS), and it allows agents to build their empires on top of our platform.

The expansion of our development team and a powerful SaaS partnership led to the launch of SERHANT. Relationship Management (S.RM), which combines CRM with a stunning array of marketing tools. Be on the lookout for our agents’ social media videos as they begin to show off a TikTok and IG-style overlay and transition engine that incorporates branded listing information and real-time auto-generated custom stickers of listing details. As we enter 2023, we will be incorporating artificial intelligence and an integration-first strategy within our application development process.

Our in-house PR team generated 900 press placements for SERHANT. this year for 16 billion impressions - a 44% increase year-over-year. PR is in our blood, and we push all of our agents and members to engage in active PR strategy as they build their own personal brands on top of SERHANT.’s platform. Whether it was the launch of SERHANT. House Hamptons, our virtual expansion with Univers, or the Penthouse at Central Park Tower (179 placements and 2.7 billion impressions alone), we were everywhere this year.

Of course, it is our people base and their successes that drive our brand’s reputation and keep SERHANT. innovations and accomplishments in the news. Our properties, new developments, and agents were covered in publications like Insider. SERHANT. STUDIOS won a Shorty Award, the Ventures team was covered in Real Trends, and I was even named to Crain's NY 40 Under 40.

Conclusion

In closing, we know that our success in anticipating market shifts, and integrating new technologies onto our platform, will provide us with a competitive advantage as we forge ahead. As the year comes to a close, it’s time that we all take stock of where we are, so that we can plan for the exciting challenges ahead. I’d like to leave you with our Mission, Vision, and Core Values, through which we all embody through our daily work and relentless commitment to what’s possible.

Our Mission: To reimagine real estate today for the neighborhoods of tomorrow.

Our Vision: A future for real estate without boundaries.

Our Core Values:

Create for Tomorrow: We live in the present tomorrow. We believe in Mission 2030. We create so that we can innovate forward. We are OK with not being understood.

Disrupt for Good: We don’t believe in breaking things just to break them. We believe in improving, growing, and refining. To help one, we must help all. We can disrupt the game by making the game better.

Be Relentless: Relentless at work and at home. Relentless in our pursuit of what’s possible for each other and our clients. Relentless in our word, our ethics, and our follow through.

Amplify Together: A rising tide lifts all ships. We are not a franchise or an affiliate and for good reason. A voice is quiet, but voices are loud. We will not go quietly and you will hear us roar.

Happy Holidays, and we will see you in the New Year.

Ryan Serhant

Founder and CEO

SERHANT.

December 21st, 2022